Tennessee State Income Tax Rate 2025

Tennessee State Income Tax Rate 2025. Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax. The tennessee tax calculator includes tax.

Tennessee residents state income tax tables for married (joint) filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold; Tennessee’s income tax rate for your wages is a flat 0%.

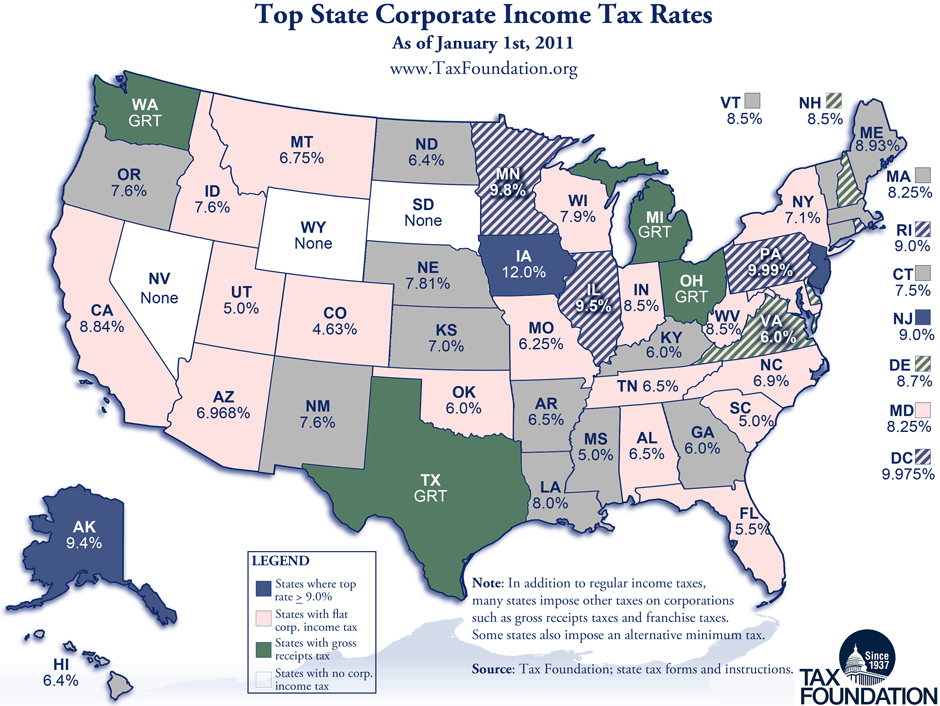

Tax rates for the 2025 year of assessment Just One Lap, Tennessee has a 7.00 percent. This paycheck calculator can help estimate your.

Ranking Of State Tax Rates INCOBEMAN, The district of columbia exempted 97 percent of businesses from tpp taxes by forgoing less than 1 percent of its property tax revenue. Tennessee state income tax calculation:

2025 state tax rate map Arnold Mote Wealth Management, 0 percent there is no personal income tax in tennessee. Tennessee state tax quick facts.

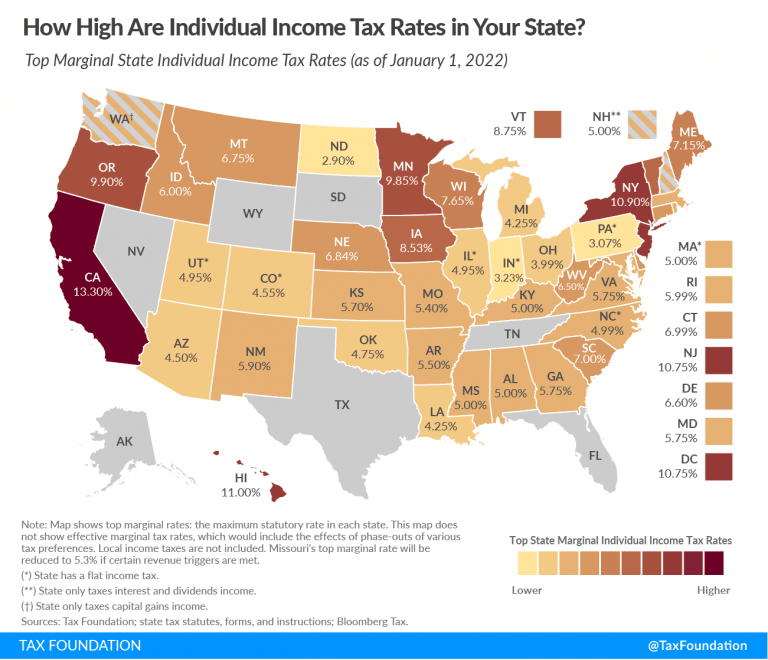

How Much Does Your State Rely on Individual Taxes?, Instead of a final rate of 4.99% in 2029, this plan would cut the rate to. State tax changes taking effect january 1, 2025.

Top State Tax Rates for All 50 States Chris Banescu, State tax changes taking effect january 1, 2025. Updated on feb 16 2025.

Taxes By State Map United States Map, Instead of a final rate of 4.99% in 2029, this plan would cut the rate to. The state income tax rate in tennessee is 0% while federal income tax rates range from 10% to 37% depending on your income.

How High are Tax Rates in Your State?, December 21, 202317 min read by: For a single tennessean with a wage of $52,000 in 2025, the take home pay is $43,664 with a total income tax of $8,336.

Tax Burden By State Map, 0 percent there is no personal income tax in tennessee. Tennessee state tax quick facts.

Hall Tax Tn Taxes Tax Information Network, New york is another state that has reduced tax rates for some income groups: California has the highest income tax rate.

Tennessee State Tax Tables 2025 US iCalculator™, Nevada, wyoming, south dakota, texas, florida and tennessee. Tennessee doesn't impose an income tax, which.

For a single tennessean with a wage of $52,000 in 2025, the take home pay is $43,664 with a total income tax of $8,336.